Every year, leading banks and investment firms offer Spring Insight programmes to first-year students, offering a chance to enhance their résumés and kickstart their early careers in finance.

The typical pathway often looks like: Spring Week → Summer Internship → Graduate Role.

But here's the challenge: with application deadlines spanning months and each firm requiring unique assessments, the process can be overwhelming and time-consuming even for the most organised students.

This is why we have developed a comprehensive, up-to-date PrepPack tailored to equip you for success in some of the top banks and investment firms.

Full accurate Preparation Packs for the following banks (Updated July 2025):

- Morgan Stanley

- JP Morgan

- Nomura

- BNP Paribas

- UBS

- Deutsche Bank

- Macquarie

- HSBC

- Jefferies

- Barclays

- Blackstone

- Standard Chartered

- Citadel

- Bank of America

- Goldman Sachs

- Schroders

- Santander

- BDO

- Crédit Agricole

- Houlihan Lokey

- Moelis & Co

- Rothschild & Co

- PJT Partners

- Citibank

- Fidelity

- Royal Bank of Canada (RBC)

Includes preparation for Aon (cut-e), SHL, Korn Ferry (Talent-Q), Cappfinity, Pymetrics, HireVue, Plum, Sova, and Suited.

This product can't be included in the Premium Membership.

Prepare with our Comprehensive PrepPack

Spring Week Preparation saves you precious time and provides the exact test simulations for each organisation with 6 months of access for only £139!

Morgan Stanley: Numerical, Verbal and Logical Reasoning tests, and Situational Judgement questionnaire provided by Aon (Cut-e)

JP Morgan: Gamified Cognitive, Social, and Behavioural assessment. Provided by Pymetrics

Nomura: Numerical, Verbal and Logical Reasoning tests provided by Aon (Cut-e)

BNP Paribas: Numerical and Verbal Reasoning tests provided by Aon (Cut-e)

Citi: Numerical and Logical Reasoning tests provided by Talent-Q (Korn Ferry)

UBS: Cultural Match Situational Judgement Test, provided by Talent Q (Korn Ferry); and Numerical, Verbal, and Inductive reasoning. Provided by Aon (Cut-e)

Deutsche Bank: Situational Judgment Test. Provided by SHL.

Macquarie: Numerical, Verbal, and Logical Reasoning tests provided by Talent-Q (Korn Ferry)

HSBC: Online Immersive Assessment – Cognitive Reasoning (Numerical, Verbal, and Inductive Reasoning) and Situational Judgment Test. Provided by Cappfinity.

Jefferies: Numerical, Verbal, and Logical Reasoning tests, and personality assessment. Provided by SHL.

Barclays: Cognitive Ability, Personality assessment, and Mindset assessment tests. Provided by SHL.

Blackstone: Gamified Cognitive, Social, and Behavioural Assessment. Provided by Pymetrics.

Standard Chartered: Gamified Cognitive, Social, and Behavioural assessment. Provided by Pymetrics, a Valued Behaviours Assessment, provided by SHL, and a HireVue Interview.

Citadel: Numerical, Verbal, Logical, Spatial Reasoning, and Personality Profiling. Provided by Wonderlic.

Bank of America: HireVue Pre-recorded Interview.

Goldman Sachs: HireVue Pre-recorded Interview.

Schroders: Cognitive Reasoning, Integrity Test, and Situational Judgement Test. Provided by Aon (Cut-e).

Santander: Numerical and Verbal Reasoning, and Situational Judgement Test. Provided by Sova.

BDO: Numerical Reasoning, Reading Comprehension, and Situational Judgement Test. Provided by Aon (Cut-e).

Crédit Agricole: Memory, English, Inductive reasoning, deductive reasoning, and verbal reasoning. Provided by Aon (Cut-e).

Houlihan Lokey: Checking, Numerical, and Logical Reasoning, and Personality Assessment. Provided by Suited.

Moelis & Co: Numerical and Verbal Reasoning. Provided by Test Partnership.

Rothschild & Co: Numerical Reasoning, Personality Assessment, and Situational Judgement Test. Provided by SHL.

PJT Partners: Checking, Numerical, and Logical Reasoning, and Personality Assessment. Provided by Suited.

Citibank: Logical Reasoning, behavioural assessments. Provided by Plum.

Fidelity: Numerical Reasoning, Personality Assessment, and Situational Judgement Test. Provided by SHL.

Royal Bank of Canada (RBC): Numerical and Verbal Reasoning, and Situational Judgement Test. Provided by Aon (Cut-e).

Prepare for success with our Summer Internship, MBB (Big 3), and Big 4 PrepPacks

Top-tier expertise meets pinpoint accuracy

Your gateway to breaking into finance through exclusive Spring Week programmes at top banks.

Our streamlined PrepPack takes the stress out of applying to multiple Spring Insight programmes simultaneously.

Since leading banks often use similar assessments, you can prepare smart, not hard, covering everything you need in one place.

No more juggling different prep materials or feeling overwhelmed by endless deadlines.

Simply select your dream banks, and we'll create a personalised study plan that gets you ready for all of them efficiently.

Get organised, stay confident, and land your spot in competitive Spring Week programmes that open doors to your future in finance!

Outstanding expertise with precision & accuracy

Save valuable time

We conduct thorough research on each organisation to provide you with tailored preparation, allowing you to focus solely on practising

Prepare specifically for the actual test you will take

Bank-specific resources, including numerical, verbal, SJT, gamified, and personality tests that mirror real assessments from SHL, Pymetrics, Talent Q, Aon, and more

Enhance your understanding

With detailed answers, explanations, and study guides, you will be guided through proven techniques and problem-solving methods to tackle every question quickly and efficiently

Improve your performance

Detailed performance reports that provide insights to identify your strengths and weaknesses, learn from mistakes, and boost your overall score

Guided Question Walkthrough

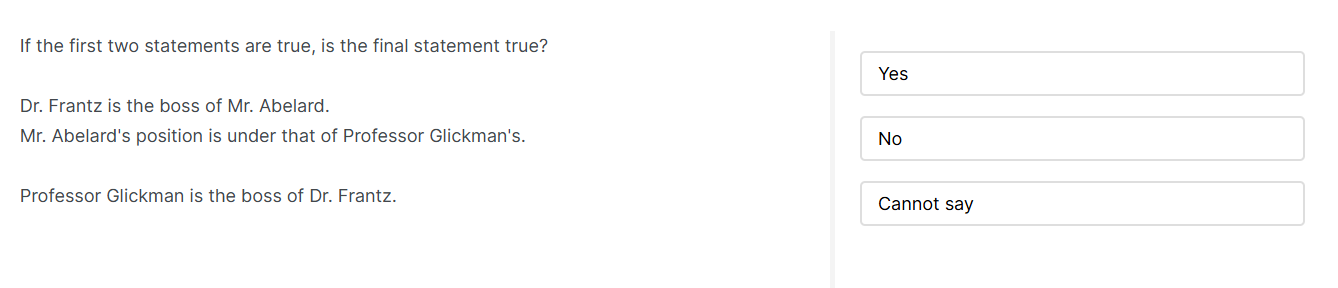

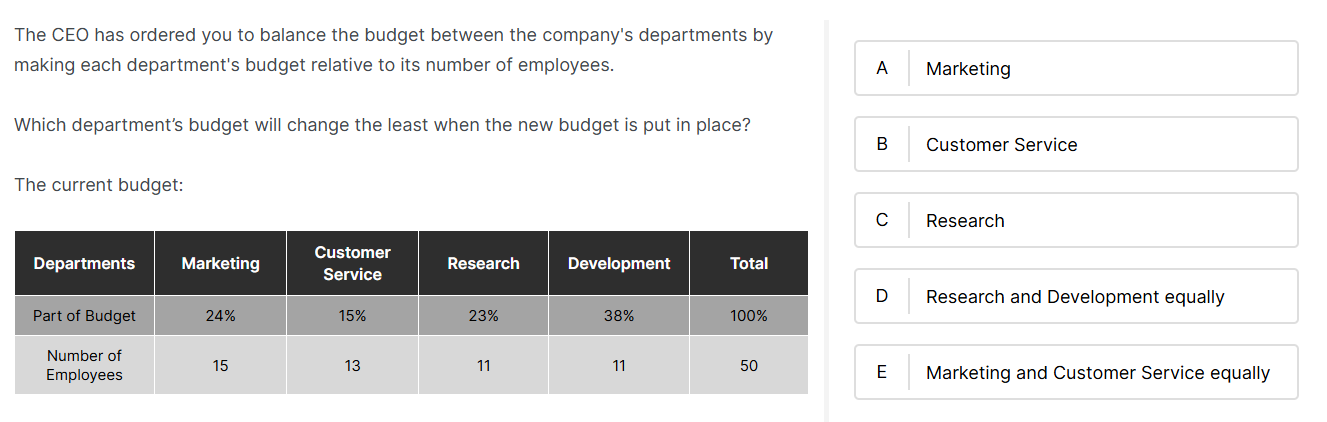

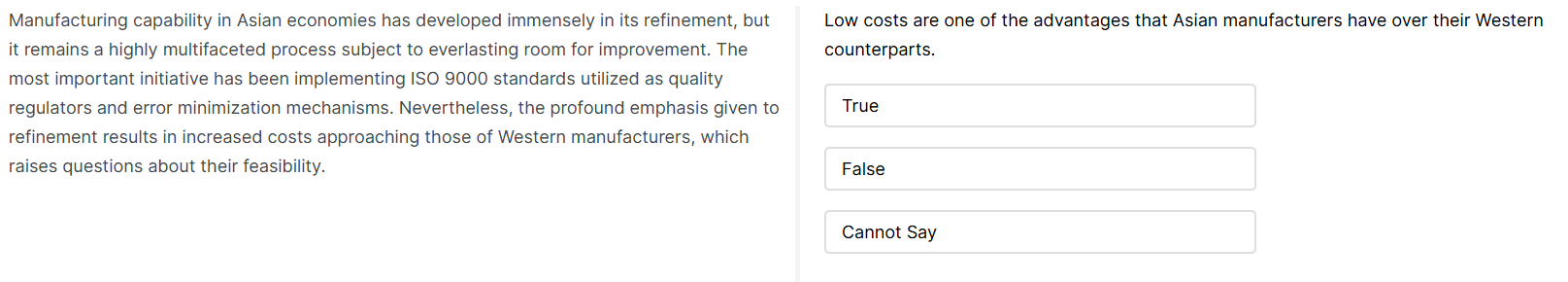

Below is a preview of a question you might encounter and with our video guide to learn how to navigate it.

Example Questions

Here’s a set of sample questions to give you an idea of what you might face.

FAQs

Spring Insight Week, also known as Spring Week, is a short, typically one-week internship that takes place during the spring term. The programme is aimed at undergraduate students in their penultimate year and serves as an introduction to the finance or business industry, offering participants a glimpse into the workings of financial institutions. Spring weeks are designed to help students build professional networks, learn about the industry, and gain hands-on experience in a corporate environment.

Many leading banks and financial institutions offer spring week internships. Some of the top companies that run spring week programmes include major banks like Goldman Sachs, Morgan Stanley, JP Morgan, Barclays, HSBC, and Citi. Investment firms, accounting firms, and management consultancies also offer spring weeks to help students gain experience and potentially secure future full-time roles.

Banks typically use several types of assessments to evaluate candidates during the spring week recruitment process. These assessments often include online aptitude tests (such as numerical and verbal reasoning tests), situational judgement tests (SJTs), and personality assessments.

In addition, candidates may be asked to participate in a pre-recorded video interview or attend an assessment centre where they engage in group exercises, case studies, and role-play tasks to assess their problem-solving, teamwork, and communication skills.

The spring Week preparation pack provides bank-specific simulations and practice materials that simulate assessments from SHL, Aon (Cut-e), Korn Ferry (Talent-Q), Cappfinity, Pymetrics, HireVue and more, allowing you to prepare efficiently for multiple firms while mastering different assessment styles.

There is no limit – you can take the simulation as many times as you want, and your progress is automatically saved, so you can revisit previous attempts and use our performance tracker to focus on areas needing improvement.