Each year, the leading banks and investment firms offer internship opportunities to students in their penultimate year, providing a life-changing chance to bolster their resume and launch their finance careers.

Since you may apply to multiple organisations, it's important to know the specific assessments you'll be facing and be well-prepared for the various test types. This can be overwhelming, particularly when considering your other academic responsibilities.

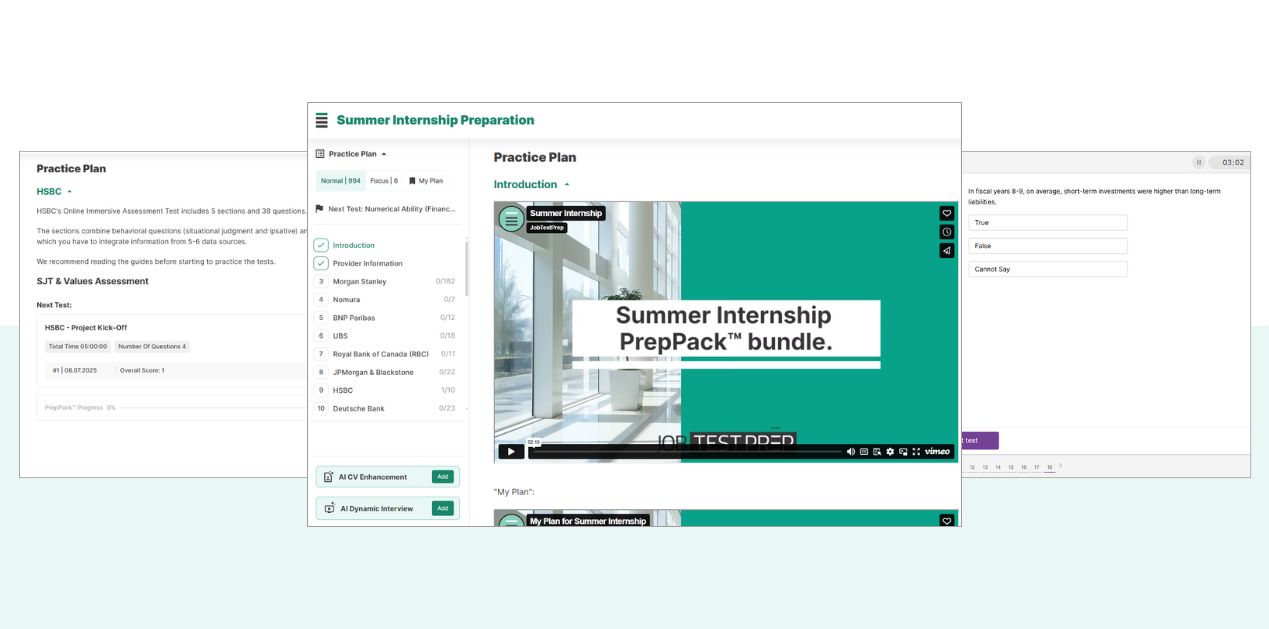

For that precise reason, we have developed a comprehensive, up-to-date preparation pack tailored to equip you for success in numerous leading banks and investment firms!

Full Accurate Preparation For Every Bank You Apply To (Updated to Summer 2026):

- J.P. Morgan

- Barclays

- HSBC

- Morgan Stanley

- Deutsche Bank

- UBS

- Blackstone

- BNP Paribas

- Fidelity

- Nomura

- Jefferies

- RBC Capital Markets

- Bank of America

- Goldman Sachs

- Citi

- Santander

- Schroders

- Citadel

- Macquarie Group

- Standard Chartered

- Houlihan Lokey

- Wells Fargo

- PJT Partners

- BDO Global

- Crédit Agricole

- Rothschild & Co.

- Moelis & Co

Includes preparation for Aon (cut-e), SHL, Korn Ferry (Talent-Q), Cappfinity, and Pymetrics (Harver).

Note: Please email us if your bank isn't on the list - and we'll work on adding it ASAP!

This product can't be included in the Premium Membership.

The Summer Internship Preparation saves you precious time and provides the exact test simulations for each organisation with 3 months of access for only £119!

Maximise your chances with our Spring Week, MBB (Big 3), and Big 4 PrepPacks!

The ultimate starting point for securing a summer internship at a leading bank.

Our all-in-one PrepPack is designed to streamline your preparation for a summer internship at a leading bank. Many banks use similar assessments, so you can prepare efficiently for all of them. You can prep for multiple banks simultaneously, saving time and energy. Tailor your preparation with the "toggle" feature and create a customized study path that helps you manage test prep for multiple banking internships, without feeling overwhelmed. Select the banks you’re targeting, and we'll deliver a focused prep library designed just for you.

Stay focused and in control with clear, structured prep designed to maximize your chances of landing your dream banking internship.

Comprehensive preparation for a

range of assessments

Many banks develop their own assessments to evaluate candidates for internship roles whilst others use a range of test providers, such as Aon (Cut-e), SHL, and Korn Ferry (Talent-Q), while others. Our comprehensive PrepPack covers both types, offering practice materials for the major test providers and for banks that use their own custom assessments - ensuring you're ready for a variety of assessment styles. Some banks use the same test providers, meaning you can prepare for multiple banks at once.

Whether it's a widely-used assessment or a bank-specific one, our PrepPack equips you with the tools to succeed.

Guided Question Walkthrough

Check out a preview of the questions you might encounter and watch our video guide to learn how to navigate them.

Example Questions

Here are a selection of example questions to help you get a sense of what you might encounter. They are commonly used by finance and banking firms in their online assessments.

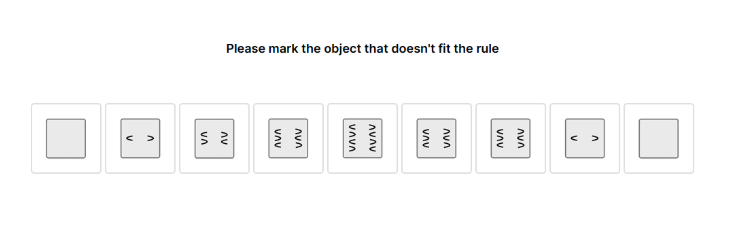

Example Question 1: Logical Reasoning - Discovering Rules

Look for the pattern these objects follow and see if you can identify which object does not fit the rule.

Test provider: Aon/Cut-e

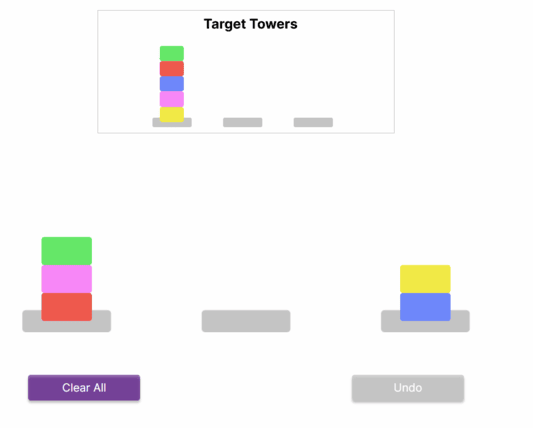

Example Question 2: Towers Game

In the Towers game, your objective is to recreate the target tower exactly—matching both its position and color pattern. You can move only one pebble at a time, and your goal is to complete the task using the fewest possible moves.

Test provider: Pymetrics

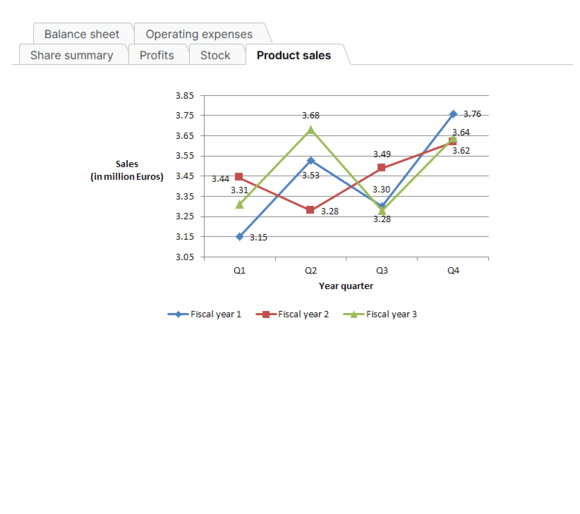

Example Question 3: Numerical reasoning - Finance

Get a taste of what Scales Numerical questions by Aon look like.

Test provider: Aon/Cut-e

You can view the entire list of firms currently included in the course by reading the purchase box, entitled "Summer Internship Preparation"

FAQs

A banking summer internship is a structured, short-term programme offered by financial institutions, typically lasting 8 to 10 weeks during the summer months. These internships are designed for undergraduate students, particularly those in their penultimate year, to gain practical experience in various areas of banking, such as investment banking, corporate banking, wealth management, and global markets. Interns engage in real-world projects, receive mentorship, and participate in training sessions, providing them with valuable insights into the financial services industry.

Numerous prestigious banks and financial institutions offer summer internship programmes that provide valuable exposure to the financial sector. Notable firms include J.P. Morgan, Barclays, HSBC, Lloyds Banking Group, Morgan Stanley, Blackstone, and Deutsche Bank.

These programmes are highly sought after and attract top talent from universities worldwide.

Securing a summer internship at a bank is highly competitive, with a rigorous application process that demands strategic preparation and proactive effort. Banks and financial institutions typically target penultimate-year undergraduate students, and the application deadlines are often set early in the academic year, so applying early is essential.

The process usually involves completing a series of assessments, including numerical, verbal, and logical reasoning tests, to evaluate cognitive skills, as well as a personality questionnaire and situational judgment tests (SJTs) that assess the approach to work-related scenarios. Additionally, candidates are often required to undergo a pre-recorded video interview, where they answer a set of standardised questions.

Tailoring your CV and cover letter to highlight relevant achievements, extracurricular activities, and soft skills such as communication, teamwork, and problem-solving will help you stand out. With limited spots available, excelling in these assessments and interviews is critical, and thorough preparation is key to succeeding in this highly competitive field.

Banks and finance companies generally use a variety of assessments to evaluate candidates for internship positions. These include types such as numerical reasoning, logical reasoning, verbal reasoning, situational judgment tests (SJTs), personality assessments, and gamified evaluations. The specific tests vary depending on the bank and the assessment provider.

The PrepPack offers tailored practice materials for a range of leading banks and investment firms. It provides simulations for various assessment providers such as SHL, Aon (Cut-e), Korn Ferry (Talent-Q), Cappfinity, and Pymetrics. This comprehensive approach allows you to prepare for multiple banks simultaneously, saving time and ensuring you're ready for different assessment styles.

View the information in the purchase box on the right-hand side of this page and browse the list of supported banks.

Please let us know which companies you want to see in our summer internship preparation pack by filling in the survey above.

After your purchase, you will receive two emails. The first will contain your payment receipt, and the second will include a login link along with information about our general terms, conditions, and refund policy. To access your PrepPack, simply log in and reset your password.

You can start practising immediately, learning from detailed explanations and guides, while tracking your performance with accurate, tailored questions to help you understand the correct approach to solving your assessment.

You can always extend your practice period. Simply contact our customer success team via c.serv@jobtestprep.com.

No, there is no limit. Your progress is saved in your account, allowing you to revisit previous attempts. Our performance tracker helps you focus on the test sections that require more attention.