Looking to be an intern in one of the top UK banks? There is a lot of crucial information to know. It is important to be ahead of the game and be ready when the finance internships open up, understand how to fully prepare for a finance assessment, and what the different stages of the process are. This article will touch on all these key points and more.

Why applications matter for accounting and finance internships

Applications for accounting and finance internships are critical as they often serve as the first step toward securing a permanent role at a leading financial institution. Being fully prepared for these applications is essential, as competition is fierce and only the best candidates move forward. Internships at top finance firms, like Barclays, provide hands-on experience and exposure to industry-specific challenges, helping interns develop the skills needed to succeed in the fast-paced financial world.

What are the stages of a finance summer internship application process?

The application process for a banking summer internship typically follows a structured, multi-step approach, designed to assess a candidate's technical abilities, problem-solving skills, and behavioural fit within the company. While the exact process may vary slightly between banks, it generally includes the following stages:

1. Online Application

The process begins with submitting your application, which usually includes your CV and cover letter. It is essential to tailor both documents to the specific bank and role you're applying for, highlighting your skills, experience, and motivation for pursuing a career in finance. Make sure your CV reflects relevant coursework, internships, extracurricular activities, and any experience that demonstrates leadership, problem-solving, and teamwork.

3 tips for writing your CV:

1. Tailor for Each Role – Customize your CV to highlight skills and achievements that match the specific job description. This shows employers you’ve researched the position and understand what they value most.

2. Show Impact, Not Duties – Use quantifiable results (e.g., “Increased sales by 20%”) instead of listing tasks. Concrete numbers make your contributions stand out and prove your effectiveness.

3. Keep It Clean and Focused – Use clear headings, bullet points, and no unnecessary details; make it easy to skim in seconds. A well-structured CV helps recruiters quickly identify why you’re a strong fit.

Use our FREE CV Analyzer to improve your CV!

2. Online Assessments

Once your application is submitted, many banks require you to complete a series of online assessments. These assessments are designed to evaluate your core abilities, including both cognitive and behavioural aspects:

Numerical Reasoning Test: This test evaluates your ability to interpret data, charts, and perform basic mathematical operations under time pressure. The focus is on speed and accuracy in solving numerical problems.

- Tip! Practice Mental Math and Work on Time Management – Numerical reasoning tests are often timed, so it's essential to improve your ability to quickly perform basic math calculations in your head. Focus on mastering percentages, ratios, and averages, and practice interpreting data from tables, charts, and graphs. The faster and more accurate you are, the better your chances of succeeding.

Verbal Reasoning Test: In this assessment, you will be asked to interpret written information, assess arguments, and draw logical conclusions. Your comprehension and analytical skills are tested, making it important to practice reading comprehension and critical thinking.

- Tip! Enhance Reading Comprehension and Critical Thinking – Focus on reading a variety of texts and practice understanding the main ideas, identifying key details, and drawing logical conclusions. Improve your ability to quickly assess the tone, structure, and implications of written material. This will help you answer questions accurately and efficiently under time constraints.

Logical Reasoning Test: Logical reasoning tests assess your ability to identify patterns, solve puzzles, and think logically. The test usually involves recognizing sequences and applying rules to different sets of data.

- Tip! Focus on Recognizing Patterns and Sequences – Logical reasoning tests often assess your ability to identify patterns in sequences, shapes, or numbers. Practice solving puzzles and pattern recognition exercises regularly to sharpen your logical thinking skills. Pay attention to common patterns, such as symmetry, progression, and changes in direction, as these often appear in test questions.

Situational Judgement Test (SJT): This test evaluates how well you make decisions in hypothetical, work-related situations. The goal is to assess whether your decision-making aligns with the bank’s values and priorities. Some banks may include gamified assessments or additional personality tests to further evaluate your behavioural traits.

- Tip! Practice Visualizing 3D Objects and Their Movements – Spatial reasoning tests assess your ability to mentally manipulate shapes and objects. Practice rotating 3D shapes, folding paper models, and visualizing how objects fit together. The more you familiarize yourself with these mental exercises, the easier it will be to quickly and accurately answer questions about how shapes interact in space.

3. Video or Phone Interview

If you perform well in the online assessments, the next step is typically an interview, which can either be pre-recorded or conducted live via phone or video. This interview focuses on competency-based questions, such as asking about your teamwork experiences, problem-solving abilities, and resilience. You may also be asked motivational questions, such as “Why do you want to work in investment banking?” or “What attracts you to our bank?”

Some banks might also incorporate technical or case study questions during this stage. These questions test your understanding of financial concepts, as well as your ability to analyze business scenarios and present solutions. Prepare for your Pre-recorded Video Interview with our AI Powered Interview Preparation!

4. Assessment Centre

The assessment centre is usually the most demanding stage of the internship application process, typically lasting half a day or more. During this stage, you will be assessed on a variety of different skills and competencies through interactive tasks and exercises:

- Multiple Interviews: You will undergo multiple interviews with different team members, which can include competency-based, technical (finance-related), and business-specific interviews. Senior staff, such as VPs or MDs, may be involved in these interviews to assess how well you fit into their team and understand their business.

- Case Study Exercise: A common feature of assessment centres, this exercise requires you to analyze a real-world business scenario and present your findings. It may be completed individually or as part of a group. This task assesses your analytical thinking, decision-making, and presentation skills.

- Group Exercises: Group tasks are designed to assess your teamwork, communication, and leadership abilities. You will collaborate with other candidates to solve problems or complete tasks, which helps the bank gauge how you perform in a team setting.

- Additional Tests or Presentations: Banks may also have additional tests or presentations, sometimes mirroring the earlier online assessments but in a live, interactive setting. These tests can further evaluate your technical or logical reasoning abilities.

- Curveball Questions or Brainteasers: To test your ability to think under pressure, you may be presented with unexpected or tricky questions during the assessment. These questions are often designed to assess your ability to remain calm and find logical solutions under time constraints.

Assessment centres may be conducted in-person or virtually, depending on the bank and its policies.

5. Final Interview (Occasionally)

Some banks may invite top candidates for a final interview after the assessment centre to make the final selection. This interview typically focuses on confirming your fit with the company culture, understanding your long-term career goals, and exploring how your skills and experience align with the role. This stage is often the last opportunity for banks to assess candidates before extending internship offers.

Important Considerations:

- Timeline: The application process for finance internships is often lengthy, with each stage typically separated by a waiting period for results. The entire process may span several weeks or even months, so patience and perseverance are essential.

- Preparation: Successful candidates will have spent ample time preparing for both the technical and behavioural aspects of the process. It’s crucial to understand the specific bank’s values, culture, and expectations to answer interview questions confidently and align your responses with their requirements.

While this structure is common across most major UK banks for summer internships, some variations may exist in terms of the number of stages or the order in which they occur. Therefore, it is vital to refer to the Tracker for detailed and up-to-date information on each specific bank’s recruitment process.

How to be fully prepared for applications

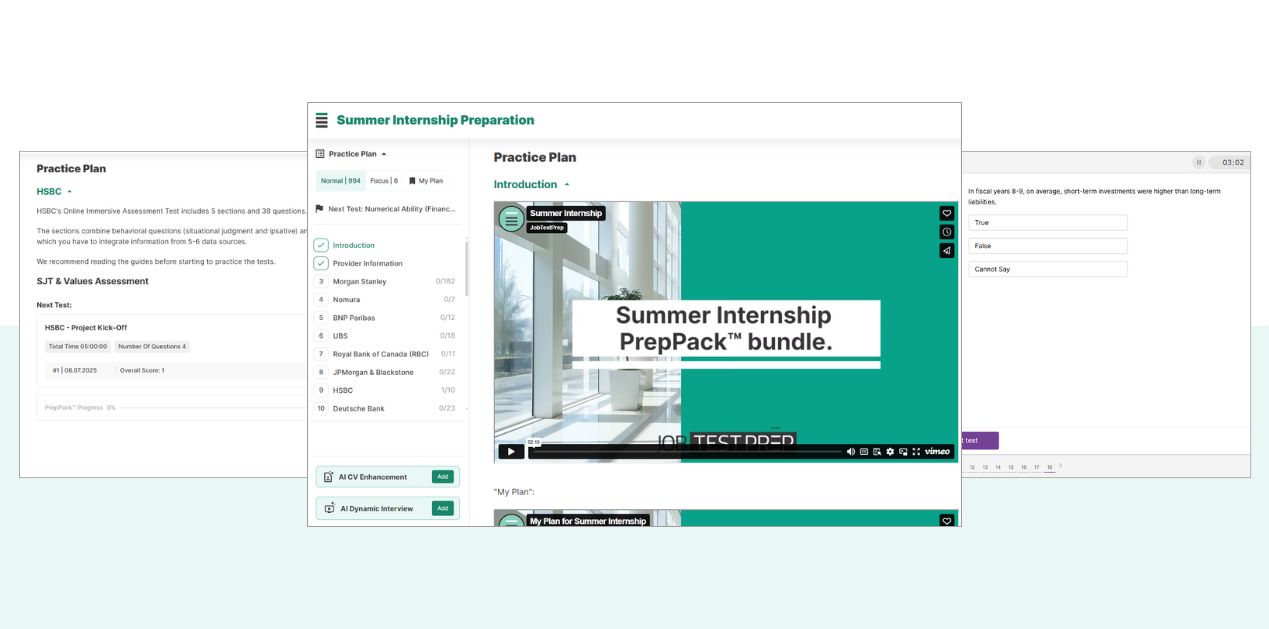

Our Banking Summer Internship PrePack is the ultimate resource for applicants looking to succeed in their banking internship assessments. With tailored preparation for 26 top UK banks, the pack offers a comprehensive and strategic approach to help you navigate the rigorous recruitment process. The pack includes assessments from leading test providers like SHL, Aon/Cut-e, HireVue, Pymetrics, Suited, Plum Korn Ferry/Talent Q, and more, ensuring you're ready for every possible test scenario.

Early preparation is crucial for success, and the Summer Internship PrePack helps you get ahead by familiarizing you with the most common assessment formats. Whether you're preparing for numerical reasoning, verbal reasoning, situational judgment tests (SJTs), or personality assessments, this pack has you covered. Additionally, it includes practice tests, full-length simulations, and detailed guides that provide a well-rounded, personalized learning experience. Organized by bank and with detailed information about the specific test providers used by each, the pack allows you to study for multiple institutions at once, streamlining your preparation.

One of the standout features of this prep pack is the AI feedback provided after each pre-recorded interview practice. This personalized evaluation allows you to receive constructive feedback on your performance and make rapid improvements by redoing the interview. Furthermore, the pack includes 12 Pymetrics games, adding a dynamic and engaging element to your preparation.

JobTestPrep’s Summer Internship PrePack is designed to ensure you're not only prepared, but confident, when it comes time to face the assessments. Don’t wait—start your preparation now and set yourself up for success with a pack that aligns with the exact assessments used by the leading UK banks.

When do finance internships open up?

Internship applications typically open one year prior to the internship start date, usually between June and November of the preceding year. For internships starting in 2026, applications will open in 2025. However, each finance firm may have different opening dates within this timeframe, so it is important to refer to the Tracker for more precise information. Keeping track of these dates will ensure you don't miss any opportunities.

Test prep for banking summer internships

To ensure success in securing a top finance internship, it’s crucial to start preparing early and thoroughly. The Summer Internship PrepPack provides the ideal resources to help you navigate the competitive recruitment process. With preparation tailored to 26 leading UK banks, the PrePack includes assessments from top test providers like SHL, HireVue, Aon, and Pymetrics, covering everything from numerical and verbal reasoning to situational judgment and personality tests.

By using the PrePack, you’ll be equipped with practice tests, full-length simulations, and personalized guidance, allowing you to prepare smartly and efficiently. The unique AI feedback feature after interview practice further enhances your prep by offering constructive, personalized evaluations to help you improve quickly.

Start your preparation now to gain the confidence and skills needed to ace your banking internship applications. Get ready for 2026 internships with JobTestPrep’s Summer Internship PrePack—the comprehensive tool designed to ensure you're fully prepared for success.

Banking Summer Internship Test PrepPack 2026

Explore our comprehensive, up-to-date preparation pack tailored to equip you for success in numerous leading banks and investment firms!